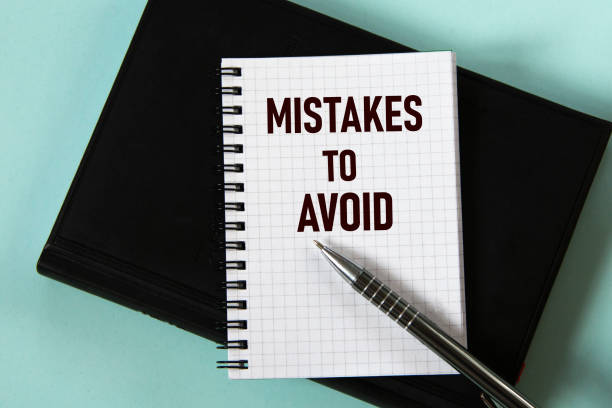

The Top 5 Mistakes you should avoid when selecting a Financial Planner

With all the ups and downs of investing, picking a good financial advisor can make all the difference when it comes to growing your money.

A 2020 northwestern mutual study found that 71% of Americans admit their financial planning needs improvement. Yet only 29% of them work with a financial advisor. While these experts can help you make the most of your investments, you have to be careful to pick the right one.

The best financial planners in the business should be knowledgeable, approachable, and offer comprehensive and sound advice to their clients. Before you start the financial planning process, there are a number of things you can do to make sure the financial planner you choose has a track record of success.

To help you find the right financial planner, here are five common mistakes to avoid when hiring a them:

Mistake 1. Looking for the lowest fee financial planners

When evaluating a financial planner, it’s crucial to remember the basics: don’t settle for someone who makes outlandish promises, who favors high-cost, high-pressure sales tactics, who tries to sell you a product you don’t need, or who tries to sell you unnecessary services.

A flashy website should not sway you. You should go with the planner with the finest reputation but make sure it is substantiated, ask for references. And most definitely, you should inquire about the planner's costs or how much they charge, but remember don’t necessarily base it on the lowest fees.

Mistake 2. Working with planners who guarantee performance or claim they can beat the market

If you’re looking for a financial planner and see an online planner claiming to beat the market or guarantee your investments will perform well, run, don’t walk towards them. A financial planner and any market predictor must show you how their predictions will perform and how they will measure this. If a planner cannot back up their claims, they can’t be trusted.

Mistake 3. Not checking their history and track record, credentials or background before contacting them

A reputable financial planner is someone who can provide you advice on your specific financial situation based on past financial experiences and given your current goals. This advice can be invaluable in helping you make the right decisions for your future and you should always consider their credentials before you choose a financial planner.

There are many financial planners out there, and the majority of them are competent. Some, on the other hand, should be avoided. You should stay away from them since they may not be honest about their qualifications and skills, or they may be dishonest. Check their background and track record online before deciding who to deal with. To verify their credibility, contact the Better Business Bureau and find out how long they have been in the industry, as well as what resources they use to make sure they are doing what is right for you.

Mistake No. 4: Not clarifying your goals and expectations with the advisor

This is a common mistake people make. For starters, don’t be tricked into choosing a financial planner who holds a degree in a subject that isn’t the same as your goals, your situation, and your financial situation. Make it clear what your short- and long-term goals are, as well as how and when you plan to communicate with your advisor. It's crucial to consider what you want to achieve with a financial advisor first – do you want investment advice? Do you need assistance with debt management or tax planning?

Mistake No. 5: Not ensuring their investment and planning philosophy matches your own

Determine if the advisor’s investment philosophy matches your own. A good tip is to make sure you look at the three Cs — cash, consistency and continuity. This means you should never hire someone just because your buddy says they gave them good returns or performance. Performance can come and go and is only one aspect of the relationship between you and your advisor. You should also make sure you click with the advisor and that you agree with their philosophy in investing and in life planning.

Conclusion:

Financial planners are great people to have around. They are knowledgeable about financial instruments, and they are well-versed with the ins and outs of insurance and retirement planning. But there are some things you should know about them and some disreputable financial planners you shouldn’t trust for your financial planning needs.

With all the ups and downs of investing, picking a good financial advisor can make all the difference when it comes to growing your money. Research shows people who work with an expert feel more at ease and end up with 15 percent more money to spend in retirement.

KK Financial Solutions can customize your portfolio to fit your needs and in accordance with your goals, account size, and risk tolerance using the 3 C’s mentioned earlier – cash, consistency and continuity.

Karen Koenig, CEO of KK Financial Solutions is a primary advisor in an office of over 50 experienced professionals with vast backgrounds and experience to support our clients’ unique goals and has passed the Series 7 and 66 exams. She is also registered in the state of Washington to sell insurance, life, disability, variable life, and variable annuities.

Visit their website at

www.kkfinancialsolutions.us.

Sources:

https://www.yahoo.com/now/7-worst-mistakes-people-hiring-122241289.html